Horse Business Expenses: Do You Know All the Expenses Involved in Running a Horse Business?

Some stable management expenses may surprise you. Here are typical horse expenses for a horse boarding and training facility.

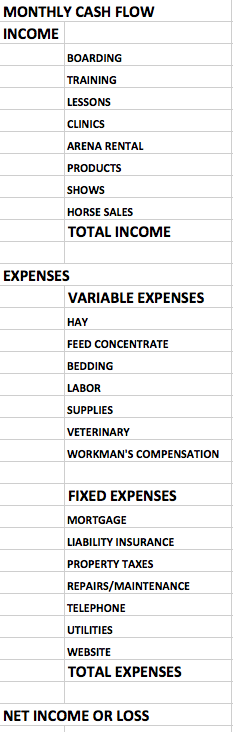

Before you start a horse business, work out a monthly cash flow so you have some idea how much money you will have each month to cover monthly expenses.

Here is a sample spreadsheet that works for most horse businesses:

Here is a sample spreadsheet that works for most horse businesses:

INCOME

As discussed here, it is usually not possible to remain profitable in a horse business solely on board income. Instead, the lion's share of horse business income usually comes from lessons, clinics, training, and horse sales.

If you allow outside trainers to give lessons or train at your facility, be sure to charge them a facility/arena usage fee. Some will object to this because "the arena is already there and my student boards here", but their activities impose costs on your facility, such as wear and tear on your arena footing. For this reason, they should compensate you for their use of your facility. Also, always be sure that they include your facility on their professional insurance policy, and that they give you a certificate showing that you're covered. If a student is injured during one of their lessons, you can be sued, so you should be covered on their policy.

Other income streams include sales of products (such as horse supplies), trailering fees, show premiums (if you have shows at your facility), and sales of horses.

As discussed here, it is usually not possible to remain profitable in a horse business solely on board income. Instead, the lion's share of horse business income usually comes from lessons, clinics, training, and horse sales.

If you allow outside trainers to give lessons or train at your facility, be sure to charge them a facility/arena usage fee. Some will object to this because "the arena is already there and my student boards here", but their activities impose costs on your facility, such as wear and tear on your arena footing. For this reason, they should compensate you for their use of your facility. Also, always be sure that they include your facility on their professional insurance policy, and that they give you a certificate showing that you're covered. If a student is injured during one of their lessons, you can be sued, so you should be covered on their policy.

Other income streams include sales of products (such as horse supplies), trailering fees, show premiums (if you have shows at your facility), and sales of horses.

FIXED AND VARIABLE EXPENSES

You may notice that your expenses divide into two categories: fixed and variable. Fixed expenses are those that remain the same regardless of how many horses you have in the barn, such as your mortgage and property taxes. Variable stable management expenses depend on how many horses you have, such as hay, feed and bedding costs.

HAY COSTS

When calculating your estimated hay costs, keep in mind that the average horse with moderate activity eats about 2% of his body weight daily in forage. So, for example, a horse that weighs 1,100 lbs needs about 22 lbs of quality hay daily. Hay bales are usually divided into flakes that weigh (again, on average) about 4 lbs. So this horse would need a little more 5 flakes daily to maintain his weight. Horses vary, however, in terms of their metabolism, so you should keep an eye on their body condition and add or subtract as needed. This is a crucial entry into your stable management expenses.

FEED CONCENTRATE

Hay doesn't usually provide all the nutrients a horse needs, and most boaters want their boarding facility to include some kind of feed concentrate in their feed regimen. (More about horse feeding regimens here.) When calculating your estimated feed concentrate (not sweet feed) costs, assumed that each horse will receive about 4 lbs daily. Throw out your coffee cans and buy the scoops that show weight markings for the brand of feed you're buying, such as Purina feeds. They will have (for example) markings one side to show lbs of Strategy and markings on the other side show lbs of Senior. When you feed, all you have to do is fill the scoop to the mark for "2 lbs". You will have a much easier time staying on budget for your stable management expenses this way.

LABOR COSTS

When you calculate labor costs, your should take into consideration that you will be paying payroll taxes and other taxes. These can increase your payroll costs by 13% or more. You may be tempted to think you could cut back on labor costs by doing stall cleaning and feeding yourself, but if you are also doing the training, lessons, show preparation, hauling to shows etc, will get "old" really fast. Think of it this way: What you charge for lessons is probably much more than what you pay in labor costs, so it is a net gain for you to hire some help. Always include extra labor help in your calculations.

Also check your state's labor laws. Many states require you to buy a workman's compensation insurance policy to cover injuries incurred on the job. For horse businesses, these policies are quite expensive.

Working students and interns are a great boon here. Working students can do stall cleaning and similar chores in exchange for lessons. Interns can be assigned chores such as feeding in exchange for learning equine nutritional needs, along with learning "the ropes" of running a successful horse boarding and training business. You can also assign chores to boarders, if they are willing to do them--but keep in mind that your insurance costs will be higher as a result. Labor costs can be very hefty stable management expenses.

INSURANCE

You will need insurance to cover damage to your property, such as fire and flooding. But horse businesses carry high liability risk, so you will need your insurance to cover you in case of suits brought by boarders. You should also structure your business legally in ways that limit your liability. More on that here.

NET INCOME OR LOSS

After you've entered all of your estimated income and expenses into the grid, take a look at your "bottom line", that is the net difference between your income and expenses. This must be a reasonably sized positive number in order for your business to thrive. The profit from your business should be reinvested to make improvements in your property. Your income must come from this as well. If your bottom line is "thin" or negative, you need to think about how to increase income or decrease expenses to actually make your business viable. To put it another way, your total expenses is the "break even" point for your business--how much you need to make to just break even.

THE MOST IMPORTANT RULE TO NEVER FORGET:

DON'T ASSUME YOUR FACILITY WILL ALWAYS FILL TO CAPACITY

DO THIS: Save your work, and make another column. Multiply the total amount of boarding income by .75 and the total amount of horse-related variable expenses by .75. Then recalculate your total income, total expenses, and net income or loss. This new total expense figure is your break even point for 75% boarding capacity. In other words, this is how much income you would have to bring in just to break even on your business, assuming that 25% of your stalls may be empty at any given time. This is an important assumption. If you need to be at 100% capacity in order to cover your fixed and variable expenses, your business will probably be in trouble in short order. You need that 25% "cushion" in your stable management expenses to ensure your business' success.

Good luck!

You can find more tips to make your horse business successful here!

Copyright Denise Cummins, PhD March 2016; updated Jan 23, 2020; Update June 3, 2024